Summary: Project Edge

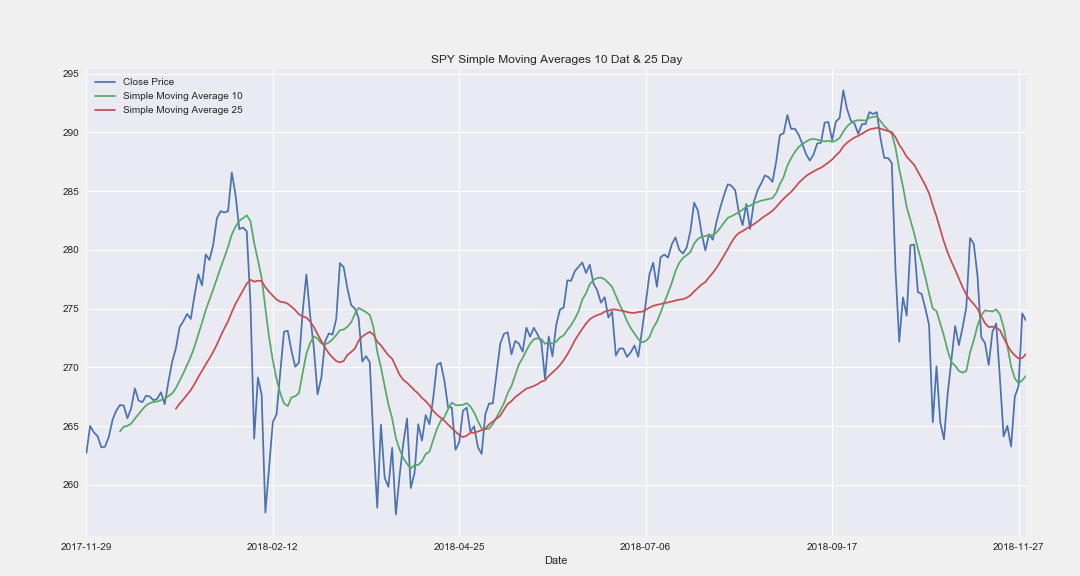

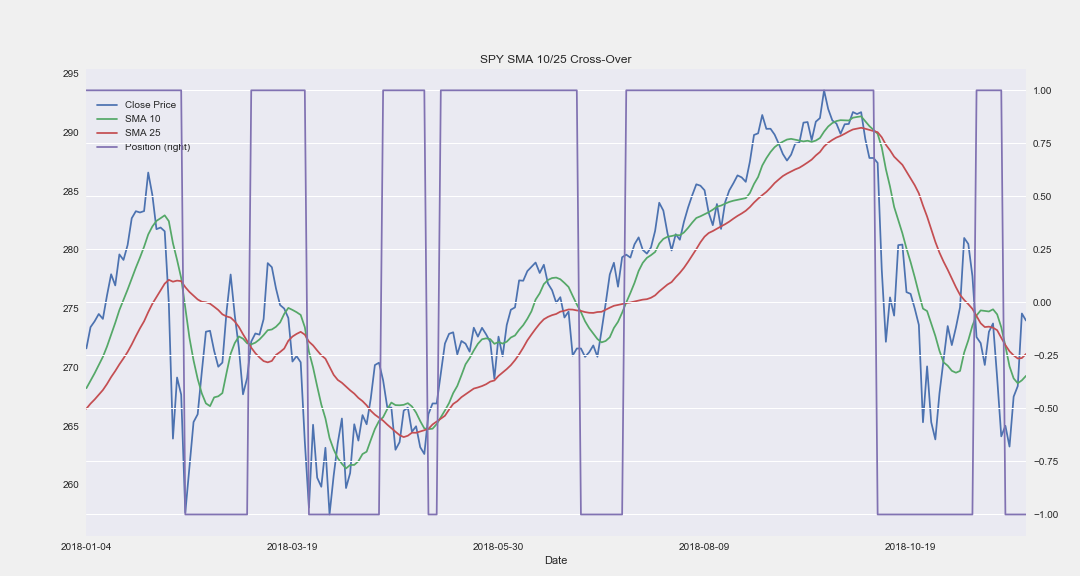

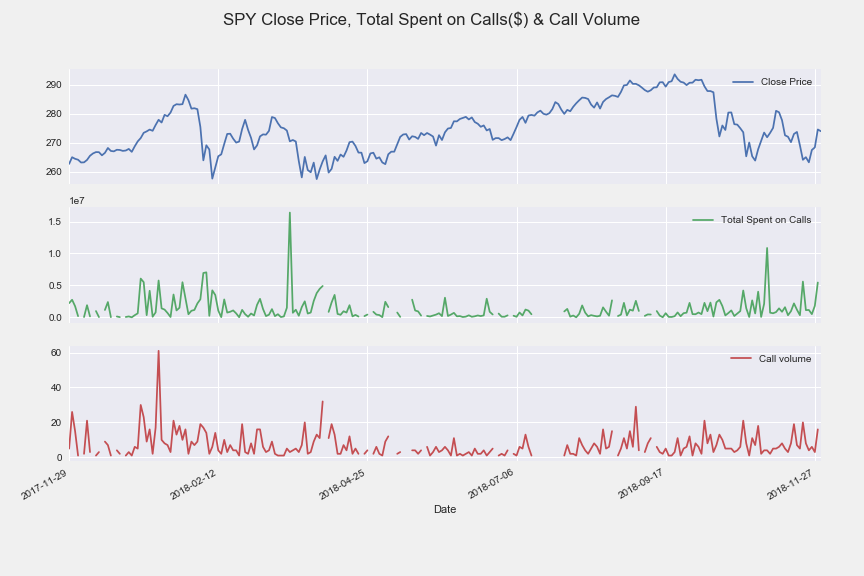

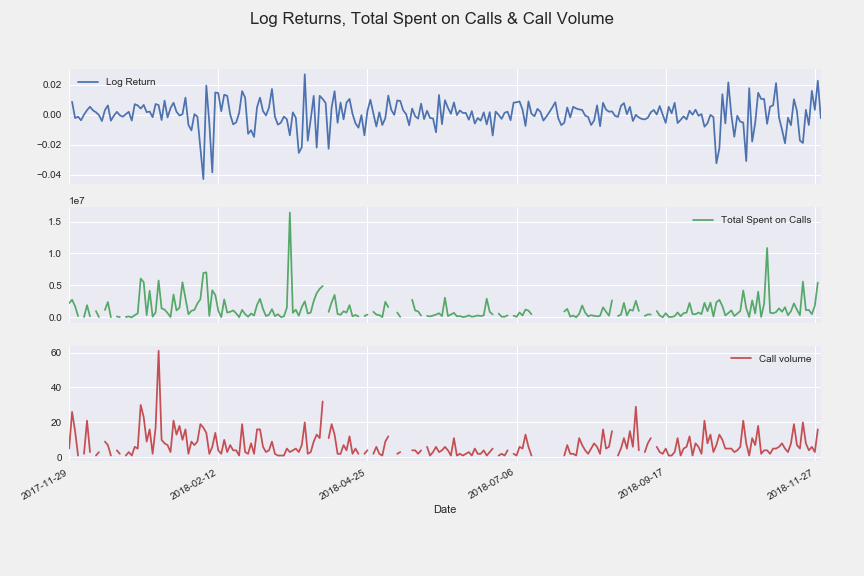

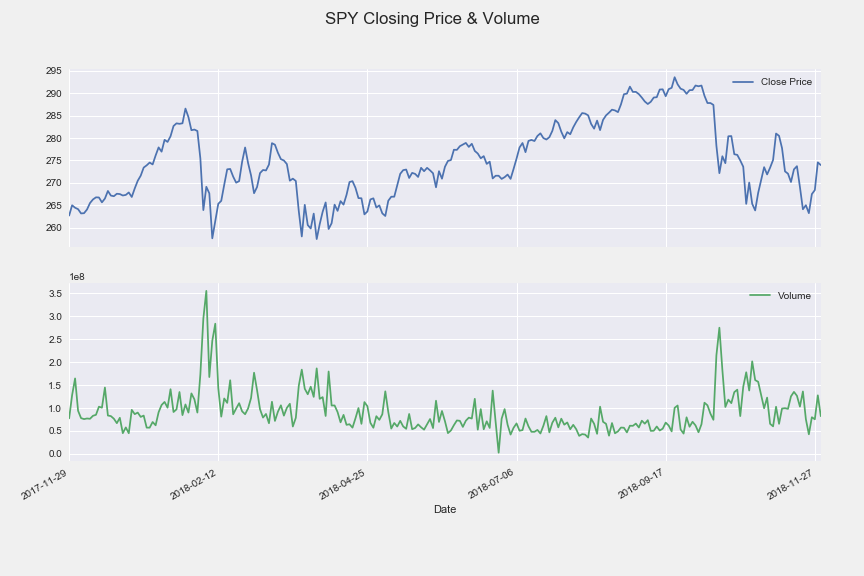

This page documents Project Edge: Finding an Edge in the Options Market by analyzing price action, volume, call option order flow. It is a work in progress. I have been working on collecting the data and writing analysis scripts for over a year using Python and SQL. The working thesis is aggressive trades in the option market can lead to momentum in the underlying stock. By analyzing aggressive order flow, I hope to find an indication of market direction, as well as confirmation that the underlying stock will move in that direction with momentum. The stock data was sourced using google finance. The option data was sourced from a curated list of option trades output by Trade-alert.com. Check out the Jupyter Notebook page to view the code used to produce the graphs and analysis.